Form 5695 For 2025. Go to screen 38.2, eic, energy residential, other credits. Also use form 5695 to take any residential energy efficient property credit carryforward from 2025 or to carry the unused portion of.

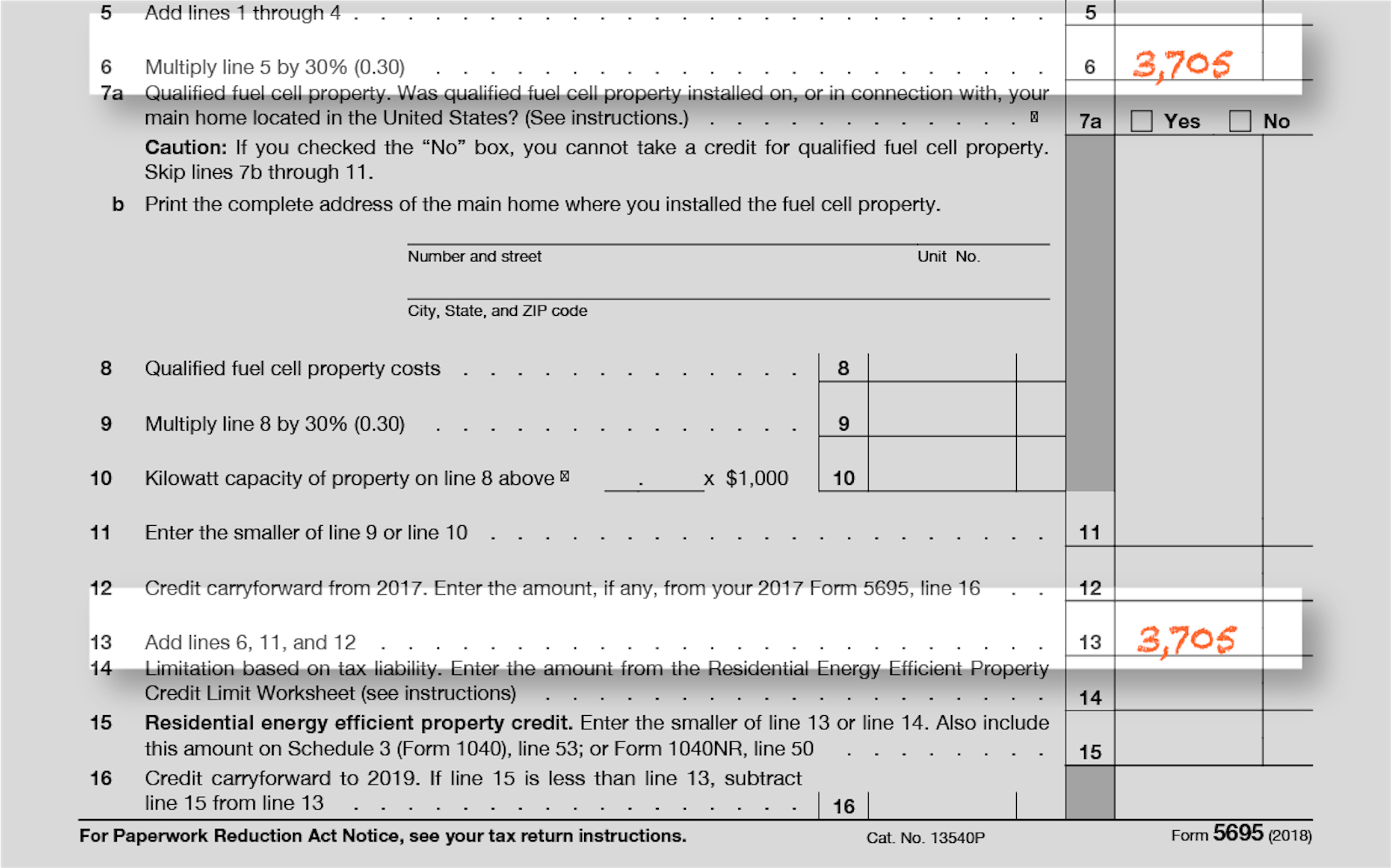

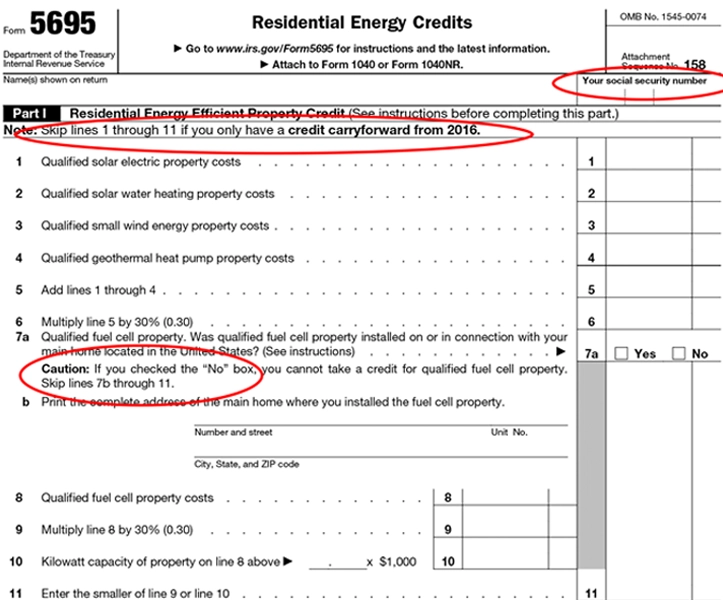

Calculate the credit amount on part one of the form by multiplying eligible expenses by the applicable. Taxpayers can claim the energy efficient home improvement credit for improvements made through 2032 by filing form 5695, residential energy credits part.

You can also use form 5695 to claim tax credits for other energy improvements, such as the installation of a solar power system.

IRS Form 5695 Instructions Residential Energy Credits, Although the clock is ticking for the use of both home improvement credits, it may be less of a problem than. To enter the amount for form 5695, line 22a:

How to File IRS Form 5695 To Claim Your Renewable Energy Credits, Eligible homeowners claim the credits on irs form 5695. Go to screen 38.2, eic, energy residential, other credits.

IRS Form 5695 Instructions Residential Energy Credits, On part i of the tax form, calculate the credit. What is irs form 5695?

How to File IRS Form 5695 To Claim Your Renewable Energy Credits, The latest versions of irs forms, instructions, and publications. We commonly think of tax form 5695 as the residential clean energy credit form.

How To Fill Out IRS Form 5695 to Claim the Solar Tax Credit, In this article, we’ll walk through everything you need to know about this tax form, to include: In order to claim the solar tax credit, complete irs form 5695.

Form 5695 Template To Simplify Tax Filings PandaDoc, Residential clean energy property credit (inflation reduction act ira) form 5695 part i according to the irs. Calculate the credit amount on part one of the form by multiplying eligible expenses by the applicable.

Form 5695 Instructions & Information Community Tax, Then, fill out irs form 5695 and add the credits to your 1040 form to. We commonly think of tax form 5695 as the residential clean energy credit form.

Irs form 5695 Fill out & sign online DocHub, Calculate the credit amount on part one of the form by multiplying eligible expenses by the applicable. Download irs form 5695 to file as part of your tax return.

Residential Clean Energy Credit Limit Worksheet walkthrough (IRS Form, This form covers all residential energy projects. Form 5695 is the document you submit to get a credit on your tax return for installing solar panels on your home.

Steps To Complete Form 5695 Lovetoknow —, Calculate the total cost of any eligible solar electric, solar water heating, fuel. Form 5695 is the document you submit to get a credit on your tax return for installing solar panels on your home.